Give to your church using a variety of assets.

Facilitating Generosity to Advance God’s Kingdom

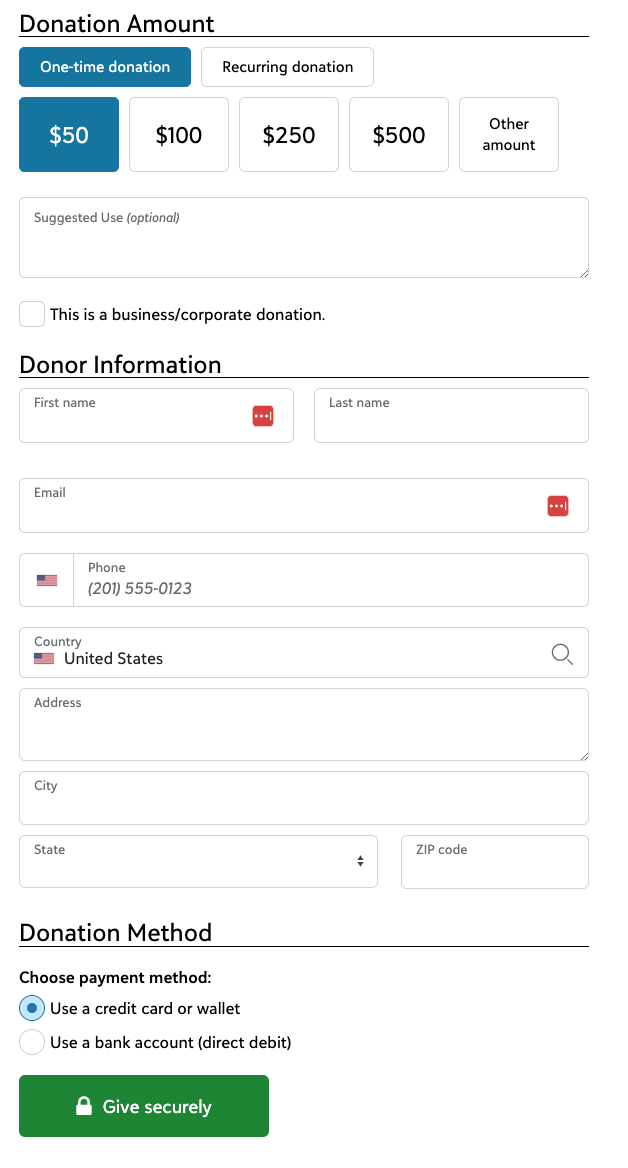

Make a Cash Donation

Give Publicly-Traded Stock

Increase the value of your gift by giving appreciated stock instead of cash. Give the amount of the increased tax savings you earn from the “double deduction:”

- Avoid tax on the capital gain in the stock market (equivalent to a deduction), while also

- Actually deducting the FULL fair market value of the stock (including the amount of that capital gain).

The PCA Foundation has the experienced personnel, processes, and brokerage accounts in place to facilitate fast and easy gifts of public stocks, funds, and bonds. Givers may direct the gift of securities into a fund established for [Church Name] at the Foundation, or establish a Foundation donor-advised fund to receive their gift. To initiate a gift, click to PCAF’S gifting instructions page and click on the appropriate category: for stocks, funds and bonds via electronic transfer, or via transfer of stock certificates.

Make a Charitable Bequest

One of the easiest gifts to make is simply to remember our church in your will, living trust, or retirement account. Instruct your legal counsel to draft a bequest in your will or charitable distribution in your living trust to “[LEGAL NAME OF CHURCH].” If instead you desire to benefit also one or more additional charities, or want to be able to change charitable beneficiaries easily and without additional cost, click here.

Donate Appreciated Property and Other Complex Gifts

Many church members can greatly increase the amount they have for giving, by even 30% to 40%, while also accomplishing personal financial and estate goals, just by giving at certain times, giving certain non-cash assets, or giving in certain ways. Envision four “buckets” for your income and wealth:

The love of Christ spread across our hearts determines the allocation among the first three buckets, and should be a matter for the Holy Spirit’s work, not manipulation by professional fundraisers and stewardship teachers. Once you have determined in your heart the three bucket amounts, thanks to tax rules, you can give at certain times, give certain assets, and give in certain ways that decrease the fourth bucket, taxes, and thereby increase the third, charitable giving, without reducing what you have determined for consumption and your personal estate.

The income tax deduction and resulting tax subsidy effectively decrease the cost of giving and thereby enable more of it. And certain kinds of giving decrease its cost and enable more of it to a much greater extent than does cash giving for immediate charitable needs or simple estate giving, frequently while also accomplishing certain personal financial and estate objectives.

Click on the following links to learn about these smart giving strategies and solutions:

- Donor-Advised Funds

- IRA Charitable Rollover

- Charitable Bequests

- Real Estate Gifts

- Partnership Interest Gifts

- C Corporation Gifts

- S Corporation Gifts

- Incentive Stock Options

- Charitable Remainder Trusts

- Charitable Gift Annuities

- Charitable Lead Trusts

- Real Estate Gifts with Reserved Life Estates

- Accelerated Estate Giving

Schedule a Conversation with a PCAF Giving Strategist

At any time complete the following form to schedule an individual consultation with a gift strategist at the PCA Foundation, or simply call the PCA Foundation at (800) 700-3221 or (678) 825-1040.

Seek Professional Counsel

Please note that neither the PCA Foundation nor your church, nor any agent of either, is permitted to, or does, provide legal, tax, or other professional representation or advice for any person’s reliance. The information we provide here or in any individual consultation is general and conceptual, and may not account for all the relevant facts of your situation or be all you need to know to make a decision about any gift. We encourage you to consult with professional counsel as you consider the information, concepts, and possible gift strategies we describe, and before you make any major, non-cash, or indirect gift.

PCA Giving Survey

A short giving survey for PCA members.

Thank you for your participation and feedback.

Give smarter.

Donor-Advised Funds

Reduce Your Taxes. Simplify Your Giving. Advance God’s Kingdom.

Complex Giving

Advanced Giving Solution. Your Kingdom Giving Goals.

Charitable Estate Planning

Our ministry includes helping you think about stewardship of your giving. You decide how much income and wealth to allocate to giving, and we help you plan how, when, and what to give during life and through the estate you leave in order to convert the most tax dollars to giving.